Starting a nonprofit initiative requires a series of financial decisions that will impact communities and social groups. Innovative programs and passionate community outreach are both driven by well-structured financial planning, requiring both stability and adaptability. The unfortunate reality is that many nonprofits face several financial challenges, from restrictions on funding to unanticipated predictions on future cost, which will build up over time for specific initiatives since resources will eventually be used up. There are several things for nonprofits to keep in mind before organizing and employing healthy financial practices.

Budgeting

Multi-phase nonprofit programs vary in cost, depending on the extent of interaction and amount of resources. It is important for nonprofits to gather good, in-depth information about the programs they want to create. Nonprofits should balance a budget based on the number of transactions they make and number of programs that make up their current initiatives. Sticking to a specific budget while also changing the cost numbers if new projects or urgent matters develop is an essential part of budgeting. Accountants could invest in quickbooks for nonprofits and other software to keep track of transactions, recording their date and cost for tax purposes.

Accountability

Under the federal law, all organizations should practice transparency. Holding nonprofit financial records accountable to the IRS, Attorney General and donors keeps nonprofits employees accountable. Several charities and donors expect financial integrity from nonprofits. A nonprofit representative should be able to provide sufficient answers about how their organization uses and manages their resources. Being accountable also requires the ability to respond to financial problems, rather than ignoring them. A contract that eased cost might end or expenses could suddenly shoot through the roof. Strong leaders in nonprofits anticipate these issues as much as possible in advance, but act quickly when these emergencies happen and won’t hesitate to prompt other employees to do the same.

Managing a nonprofit is somewhat different from managing a corporation. Budgeting is more difficult to manage due to a more relaxed, choice-based structure that doesn’t rely on consistent exchange. However, nonprofits should still commit to budgeting if they want to operate long-term and remain accountable and transparent.

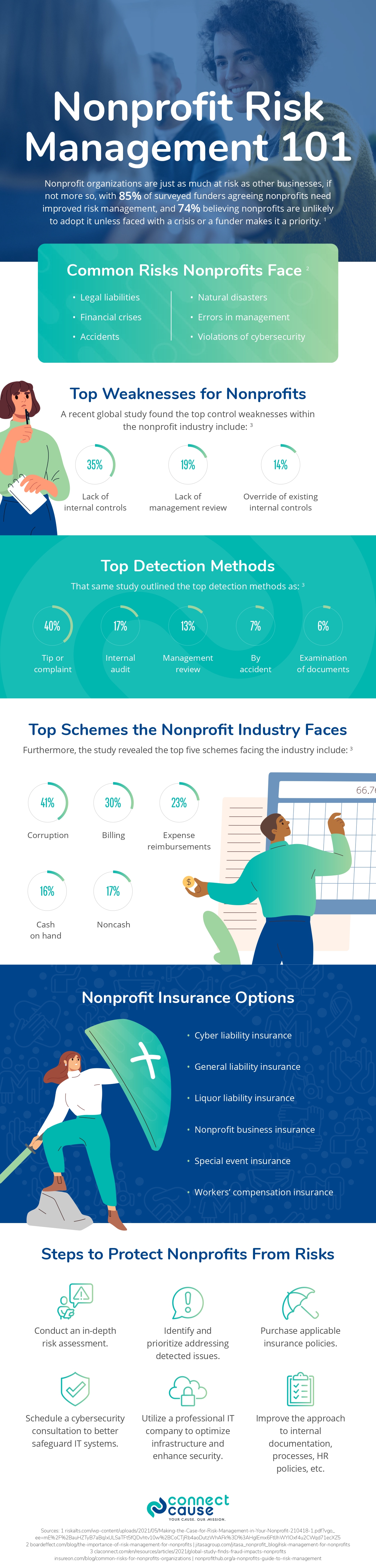

Infographic Provided By Managed IT Services For Nonprofits Company, Connect Cause